SAP-Consulting

SAP-Consulting

SAP ILM

How to manage the lifecycle of your SAP data

SAP Information Lifecycle Management (ILM)

SAP Information Lifecycle Management (ILM) is a comprehensive solution that helps companies efficiently manage their data throughout its entire lifecycle. ILM ensures that data is archived, retained, and deleted in accordance with legal, regulatory, and company-specific requirements. It plays a critical role in optimizing data management and helping to minimize risks associated with uncontrolled data storage and management.

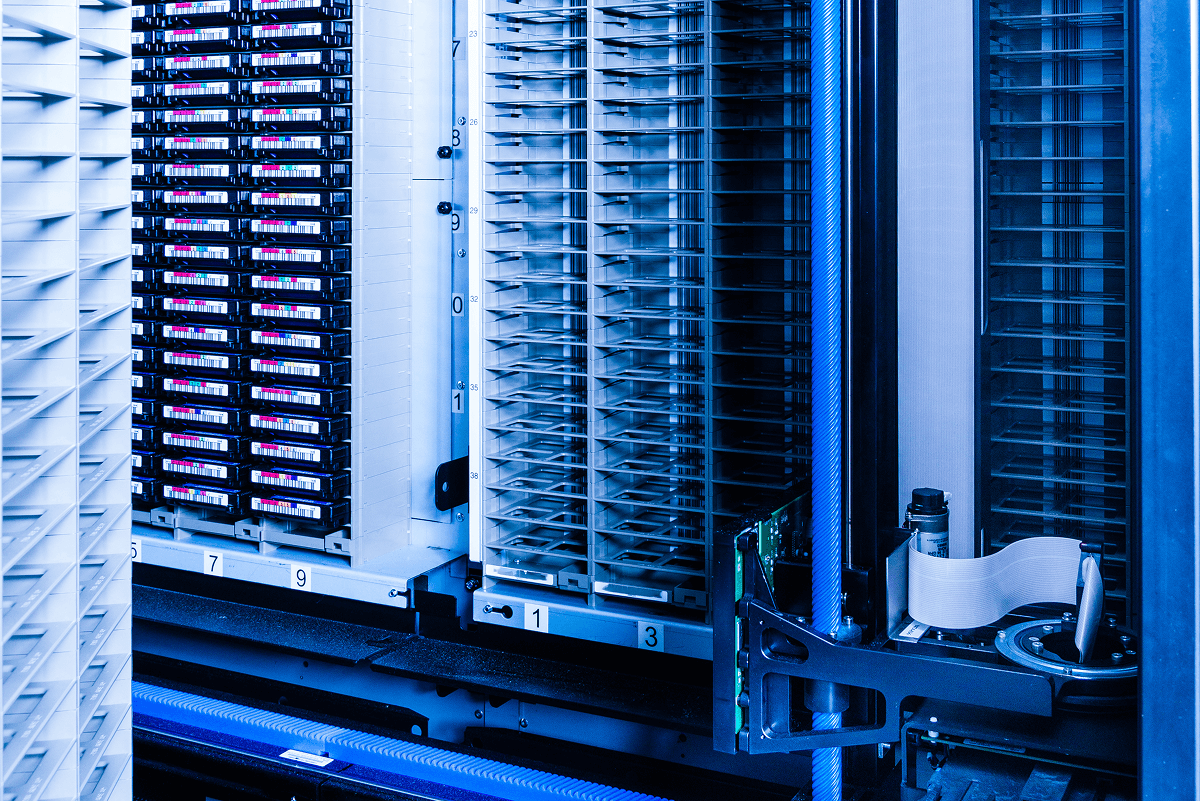

Data archiving and storage

SAP ILM enables effective and structured archiving of data that is no longer actively used but must be retained for legal or business reasons.

Compliance and legal requirements

ILM ensures that data is retained and deleted to meet the requirements of laws such as the General Data Protection Regulation (GDPR) and other regulatory regulations.

Resource optimization

Targeted archiving and deletion of data reduces storage requirements and improves the system performance of SAP applications.

Key Benefits of SAP ILM

Compliance Security

SAP ILM helps meet legal retention requirements by enabling transparent and traceable data management that takes into account both legal requirements and industry-specific regulations.

Reduction of Storage Resources

Archiving data that is no longer needed makes more efficient use of expensive storage resources and optimizes the infrastructure.

Improved System Performance

ILM contributes to improving SAP system performance because less data needs to be processed in active systems.

Automation and Efficiency

ILM enables the automation of the entire data lifecycle, from archiving to deletion, which reduces administrative effort and minimizes sources of error.

Key Features of SAP ILM

1Blocking Master and Transactional Data

ILM enables the blocking of data once its intended use no longer applies (End of Purpose = EoP). Master data is blocked using block indicators, and transaction data is blocked using authorization groups on archive files.

2Retention and Deletion Policies

Companies can define specific retention policies for different data types to ensure that data is retained only for as long as necessary and then properly deleted.

3Legal Case Management

SAP ILM uses Legal Case Management to prevent data required for a legal case and marked accordingly from being destroyed after the retention period has expired, so it remains accessible if needed for audits or legal purposes.

How can we support you with SAP ILM?

Conception and implementation

We develop an ILM concept based on your specific requirements and set up the customization for you. Creating legally required documentation in the form of best practice detailed concepts is a standard part of our service.

Data protection and compliance

We support you in implementing the EU GDPR and other regulatory requirements through the proper configuration of SAP ILM and ensure that all legal requirements are met.

SAP Data Archiving

How to control the data volume in your SAP systems

SAP Data Archiving

SAP Data Archiving is an essential component of efficient data management and storage in companies that use SAP systems. It enables companies to securely and compliantly archive large amounts of data that are no longer needed regularly, while simultaneously optimizing system performance and efficiently utilizing storage resources.

The challenge of modern data management lies in the increasing volume of data generated by SAP applications and the need to retain this data over an extended period of time. Legal requirements, such as the General Data Protection Regulation (GDPR) or tax regulations, demand careful and traceable handling of this data. Effective data archiving ensures that these requirements are met without disrupting ongoing operations.

Key Benefits of SAP Data Archiving

Cost Reduction

Archiving reduces the need for expensive storage resources, thus improving cost-effectiveness.

System Performance

Removing old and rarely used data from the active system increases the performance of SAP systems.

Compliance

SAP Data Archiving helps companies meet legal retention requirements and reduces the risk of compliance violations.

Process Optimization

Archiving enables structured data management and facilitates access to archived data when needed.

How can we support you with SAP Data Archiving?

Archiving Strategies

We develop the best possible archiving strategy for your company, taking into account all specific requirements (legal, functional, and technical) to ensure that only relevant and required data is archived.

Design and Implementation

We identify the relevant SAP Data Archiving objects whose tables are growing rapidly and negatively impacting system performance. Creating legally required documentation in the form of detailed best-practice concepts is a matter of course for us. Customer-specific requirements are considered and implemented during implementation.

Operation and Support

We are happy to take over the operation for you and create a long-term archiving plan for this purpose. Individual support and tailored coaching ensure that your internal administration team can contact our experts at any time for questions and challenges.

SAP System Decommissioning

How to deactivate your legacy SAP systems

SAP System Decommissioning

SAP system decommissioning is the process of decommissioning an SAP system that is no longer actively used. This step is often part of a larger digitalization or modernization process that includes IT landscape consolidation, migration to new SAP software versions such as SAP S/4HANA, or the transition to cloud solutions. Successful system decommissioning is crucial for companies looking to optimize their IT infrastructure while meeting legal, operational, and data protection requirements.

Main objectives of SAP system decommissioning

Reducing costs and complexity

Decommissioning legacy SAP systems reduces maintenance, support, and operational costs, and simplifies the system landscape.

Optimizing system resources

Reducing the number of systems reduces infrastructure complexity and improves the performance of the remaining systems.

Compliance and legal requirements

Decommissioning involves archiving and/or migrating data to ensure compliance with all legal retention periods and data protection requirements.

Key Benefits of SAP System Decommissioning

Cost Reduction

Decommissioning SAP systems that are no longer required saves long-term costs for maintenance, licenses, and infrastructure.

Increased Efficiency

A consolidated and simplified system landscape leads to improved performance and better management of IT resources.

Legal Compliance and Compliance

Careful archiving of data and adherence to retention and deletion guidelines ensure that legal and regulatory requirements are met.

Risk Mitigation

Decommissioning legacy systems reduces potential security risks and complexities that can arise from outdated software and hardware.

Key Features of SAP System Decommissioning

Data Migration and Archiving

During decommissioning, data is either migrated to a new system or securely archived to ensure access to historical data and meet compliance requirements.

System Decommissioning

Following migration or archiving, the SAP system is finally decommissioned. This step must be carefully planned, taking into account the system's internal dependencies and integrations.

Documentation and Follow-up

All steps of the decommissioning process must be documented to ensure that all data has been handled properly and that the process is auditable.

How can we support you with SAP system decommissioning?

Decommissioning Strategy

We develop the best possible decommissioning strategy for your company, taking into account all specific requirements (legal, functional, and technical) to ensure that only relevant and necessary data is archived.

Benchmarking and Solution Comparison

The market for software in the area of system decommissioning is complex and only comparable to a limited extent. There are solutions based on SAP software, but also many that are not based on SAP software, which bring with them new requirements. Our experts are familiar with all leading providers on the market and can provide you with an independent and honest comparison and recommend the best provider for your specific requirements.

Implementation Partner

We are happy to support you in all phases of SAP system decommissioning with our many years of expertise and would be pleased to present our internal decommissioning tools and methods to you in a personal meeting.

SAP DART

How to correctly extract your tax-relevant data

SAP Data Retention Tool (DART)

During tax audits, auditors and tax auditors access IT-based tools to analyze the quality of tax-relevant data in an SAP system using statistical methods. These analyses are intended to provide information about the accuracy of the data. However, this tax-relevant data must first be extracted from the SAP system using an IT tool and provided in the format requested by the auditor.

Tool Overview

The Data Retention Tool (DART) is described for the extraction process. It is available as standard in every SAP system at no additional cost. Alternatively, there are also paid tools that can include archived data in the extraction process in addition to the data in the database. DART can only extract from the database, which is why the extraction must be performed before the data is archived.

For analyzing the data from the DART extract, I will briefly introduce the products of the two leading audit software providers, ACL and CaseWare. Even if the two products ACL and IDEA are not directly required for data archiving, you should be familiar with them in the context of data archiving.

DART is used to extract tax-relevant data from the SAP system. It was originally developed to meet the requirements of the tax authorities in the USA, but has also been used in Germany since 2002. In recent years, other countries have also adapted their laws and introduced new guidelines for electronic tax audits. DART has been used in these countries since then.

Main objectives of SAP DART

Extraction of tax-relevant data

SAP DART enables companies to extract tax-relevant data for a tax audit and then securely delete it to comply with legal requirements.

Provision of tax-relevant data

The tool ensures that view files can be created from the previously generated extract files and submitted to the tax auditor. International compliance requirements and file formats are taken into account accordingly.

How can we support you with SAP DART?

Conception and implementation

We identify the tax-relevant data and tables and configure the customization for you. Creating legally required documentation in the form of detailed best-practice concepts is a matter of course for us. Customer-specific requirements are considered and implemented during implementation.

Operation and support

We are happy to take over the operation for you and create a long-term extraction and audit plan. Individual support and tailored coaching ensure that your internal administration team can contact our experts at any time if they have questions or challenges.

Expert Ahmet Türk's recommendation

SAP solutions are essential tools for companies that need to manage their data efficiently and in compliance. They provide complete control and ensure that all legal requirements are met. By implementing the right solutions, companies can improve the security and performance of their systems while minimizing the risk of compliance violations.

Contact us today so that we can tackle the challenges in your company together.